The Middle Class is So Christmas Past 2017

Republicans promised the American people a tax bill for Christmas, and this week they delivered. It’s definitely a bill for working people and the poor because by 2025, they’ll pay more. For them, poverty is the new black.

By contrast, Congress bestowed 83 percent of the new tax law’s benefits on the richest 1 percent. For them, greenbacks are the new black.

On the first day of Christmas

The GOP gave to me

A tax break for the wealthy

The 1 percent have already roasted and eaten the partridge, the pair of turtle doves, the three French hens, the four calling birds, the six geese, even the seven swans. They are, after all, very rich. And now, with these tax changes, Republicans in Congress have swiped Tiny Tim’s turkey and handed it to the wealthy so they can gorge themselves on it too.

Republicans hate income redistribution when it flows from the tony top down to impoverished Cratchits. But they delight in reaching into working people’s pockets and converting those coins into golden rings for the rich. That’s exactly what the GOP tax bill does.

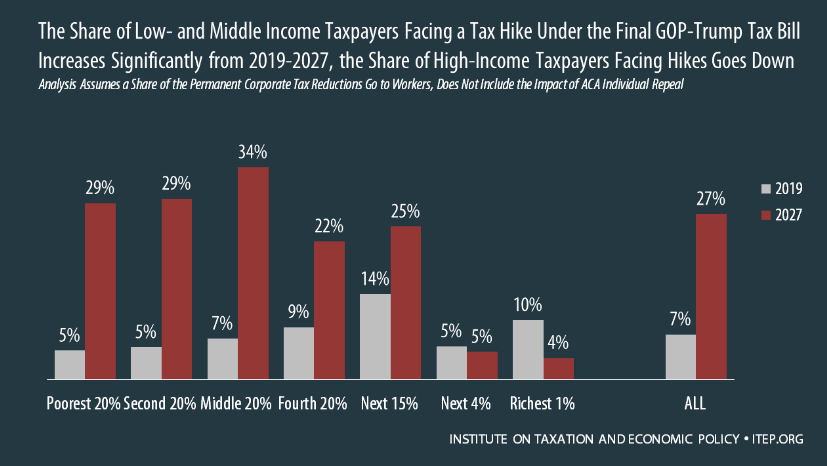

The meager tax breaks awarded the working poor and middle class in this tax bill expire, like Cinderella’s outfit and entourage, before the tolling of a decade. In addition, the bill increases other costs for workers.

For example, it changes the way tax brackets are indexed to inflation. That means workers will enter higher brackets faster, even though their incomes don’t rise any quicker. This will cost the middle class and poor $25.6 billion, which the GOP used to offset the big fat breaks it gave the rich and corporations.

The new inflation index is meaningless to the rich. They don’t change tax brackets after reaching the top. For them, the marginal rate – lowered from 39.6 percent to 37 percent – remains the same whether they earn $500,000 or $5 million.

On top of the inflation index scam, the tax bill will raise health insurance premiums because it repeals the mandate that all Americans carry coverage. Without the requirement, fewer people will buy insurance. Initially, that’s likely to be younger and healthier people. As a result, older and sicker people will be concentrated in plans, increasing costs by about 10 percent every year. That, in turn, will force out those who can’t afford the higher premiums. The number of uninsured by 2019 is estimated at 4 million; by 2027, it’s 13 million.

But, hey, look on the bright side, the feds won’t pay as much to subsidize poor people’s health insurance when so many drop out. Thirteen million uncovered Americans enabled Republicans to give $53.3 billion in tax breaks to the rich! That’s jolly, right?

Have a holly, jolly Christmas;

It’s the best time of the year

I don’t know if there’ll be snow

but have a cup of cheer

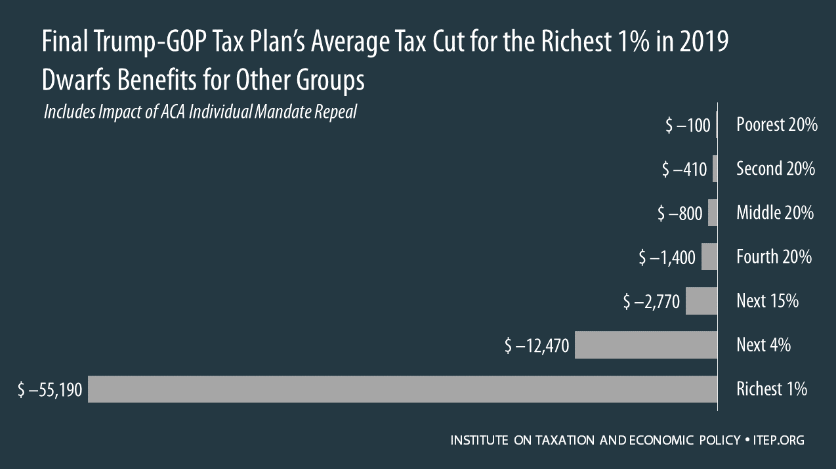

Workers will need some cheer when the bills come due even as they watch the wealthy use their tax handouts to buy extra Mercedes for Christmas. Every year. The average tax break for the 1 percent will be $55,000. That’s a couple thousand dollars more than the median income in the United States, in other words, what all of the workers in a typical American household make together for an entire year.

Also, fewer wealthy people will have to pay that pesky alternative minimum tax charged when excessive loopholes zero out tax bills. Real estate tycoons and others operating “pass through” corporations get a huge break as well. And couples can now bequeath $22 million to their kiddies tax free, instead of the current piddling $11 million!

And it is the rich who will benefit from the slashed corporate tax rate – which free falls from the current 35 percent down to 21 percent. That big fat turkey doesn’t expire either. It means higher dividends for shareholders – that is CEOs, trust fund babies and others rich enough to own stock.

Corporations could invest that money in new ventures, new factories and new jobs. But precious few will. Here is what Wells Fargo CEO Tim Sloan said he would do with the extra cash: increase dividends and share buybacks. When corporations buy back shares, stock value rises and CEO pay with it.

During a forum for CEOs in November, a Wall Street Journal editor asked how many would invest their tax breaks. Almost no one raised a hand. Corporations already are hauling in record profits, and they’re not investing. They’re handing the cash to the already-rich – shareholders and corporate executives. Just like Republicans did in their tax bill.

Have yourself a merry little Christmas

Let your heart be light

From now on your troubles will be out of sight

Well, if you’re rich, that is. Troubles are just starting for the rest of us.

That’s because this tax bill is worse than NAFTA in promoting offshoring. As it is now, corporations are charged the 35 percent tax rate on profits whether they are made at U.S. factories or overseas plants. But the new tax bill virtually eliminates the charge on overseas operations. The result is that a corporation will pay four times more taxes if it locates its big new factory in the United States than if it puts the plant overseas. That creates a perverse incentive to move even more jobs offshore.

We wish you a Merry Christmas,

We wish you a Merry Christmas,

We wish you a Merry Christmas,

And a Happy New Year.

Hope that New Year doesn’t include a pink slip because your CEO decides to ship your factory to China.

But there’s likely to be some bad news anyway. Speaker of the House Paul Ryan has said he intends to “reform” Medicaid, Medicare and Social Security next year to help pay down that $1.45 trillion he just added to the national debt with his tax breaks for the rich and corporations.

Republican “reform” always means pain for working people – like raising the age at which a worker would qualify to collect Social Security and Medicare. And like cutting Medicaid funding so grandma can’t stay in the nursing home and the kid next door can’t get into treatment for heroin addiction.

The GOP really is the Grinch that stole Christmas. Republicans filched it and handed it to the wealthiest 1 percent – that is households worth at least $26.4 million. Unlike the Dr. Seuss story, this Grinch isn’t going to find a heart or the spirit of Christmas future or whatever it takes to stop robbing workers and the poor.

You’re a rotter, Mr. Grinch

You’re the king of sinful sots

Your heart’s a dead tomato splotched with moldy purple spots, Mr. Grinch

Your soul is an appalling dump heap overflowing with the most disgraceful

Assortment of rubbish imaginable mangled up in tangled up knots!

By clicking Sign Up you're confirming that you agree with our Terms and Conditions.

Related Blogs

Ready to make a difference?

Are you and your coworkers ready to negotiate together for bigger paychecks, stronger benefits and better lives?